vermont state tax rate 2021

Vermont Tax Brackets for Tax Year 2022. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

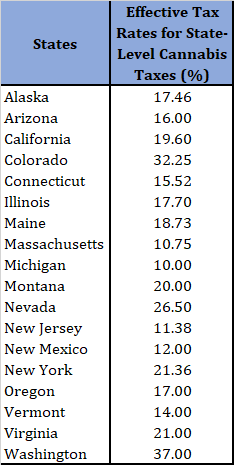

Assessing State Level Adult Use Cannabis Taxation Aaf

Vermont also has a 600 percent to 85 percent corporate income tax rate.

. VT Taxable Income is 82000 Form IN-111 Line 7. At Least But Less Single Married Married Head of. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Tuesday January 25 2022 - 1200. And your filing status is. Tuesday January 25 2022 - 1200.

TaxTables-2021pdf 22999 KB File Format. Any sales tax that is collected belongs to the state and does. Detailed Vermont state income tax rates and brackets are available on this page.

2021 Vermont Tax Tables. They vary based on your filing status and taxable income. Find your pretax deductions including 401K flexible account.

Tax rate of 335 on the first 40350 of taxable income. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Vermont has four state income tax brackets for the 2021 tax year. 2021 Vermont Tax Tables.

Find your income exemptions. Groceries clothing prescription drugs and non-prescription drugs are exempt from the. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

2022 Interest Rate Memo. Detailed Vermont state income tax rates and brackets are available on this page. The table below shows rates and.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Tax Rates Cigarette Tobacco Tax Rates Education Property Tax Rates Individual Tax Tables and Rate Schedules Local Option Tax Zip Codes Tax. Tax rate of 66 on taxable income.

Filing Status is Married Filing Jointly. Than filing filing house- jointly. Vermont Single Tax Brackets TY 2021 - 2022.

They vary based on your filing status and taxable income. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is. State government websites often end in gov or mil.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules.

How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table. TAX TABLES Place at. Vermont Credit for Income Tax Paid to Other State or Canadian Province.

RateSched-2021pdf 3251 KB File Format. Individuals Personal Income Tax. Any income over 204000 and 248350 for.

2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Tax rate of 66 on taxable income between 40351. Before sharing sensitive information make sure youre on a state government site.

Rates range from 335 to 875. If Taxable Income is. Here is a list of current state tax rates.

Vermont Estate Tax Everything You Need To Know Smartasset

Tax Revenues Soar With One Time Money Vermont Business Magazine

Where Is Vermont S Newly Approved 7 32 Billion Budget Going Vtdigger

Vermont Department Of Taxes Montpelier Vt

Appeal Property Tax Assessment In Vt Msk Attorneys

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

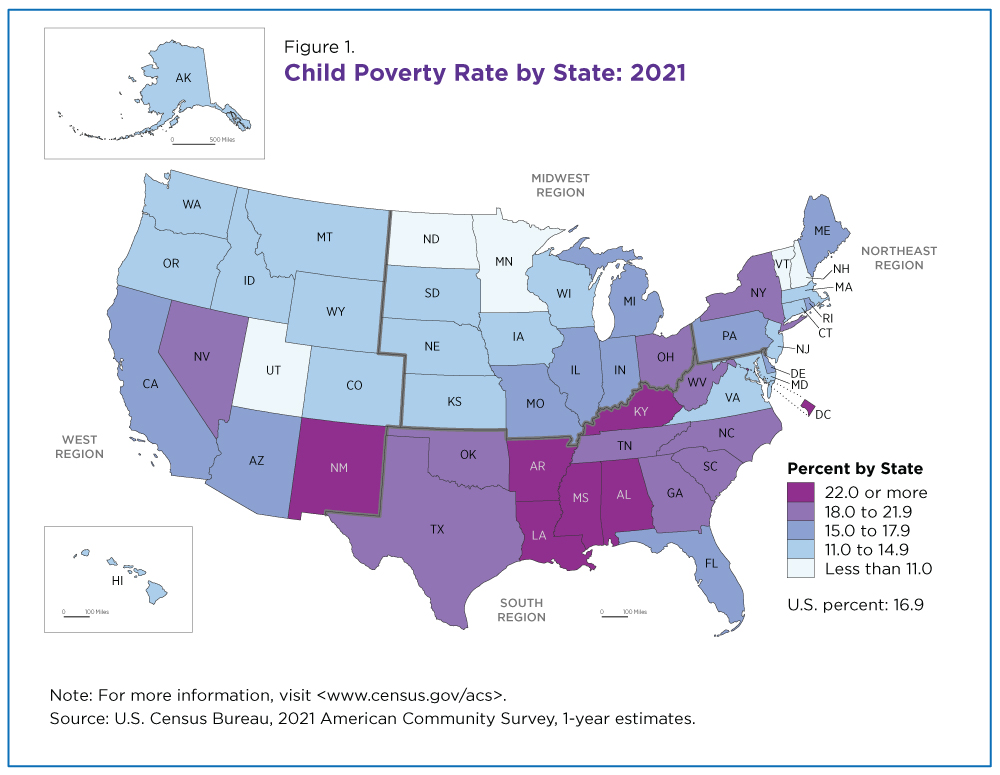

Vermont Childhood Poverty Rate Among Lowest In Us Vermont Business Magazine

Novel Coronavirus Covid 19 Vermont State Response Resources Office Of Governor Phil Scott

Pai Vermont S Tools For Education Funding Equity Weighting And Categorical Aid Vermont Business Magazine

Pai Vermont School Funding Questions Answered Vermont Business Magazine

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Top States For Business 2021 Vermont

Vermont State Tax Software Preparation And E File On Freetaxusa

Vermont State Tax Tables 2021 Us Icalculator

State Individual Income Tax Rates And Brackets Tax Foundation

High Home Prices Persist In First Half Of 2021 Vhfa Org Vermont Housing Finance Agency